Hong Kong's budget is truly for the people, unlike..........

-

Improving People's Livelihood and Supporting Disadvantaged Groups

To allocate $4.3 billion to inject into each domestic electricity account a subsidy of $1,800.

To allocate $4.3 billion to inject into each domestic electricity account a subsidy of $1,800.  To inject $1 billion into the Samaritan Fund so as to relieve the financial burden on needy patients.

To inject $1 billion into the Samaritan Fund so as to relieve the financial burden on needy patients. To support and take care of the elderly in need:

To support and take care of the elderly in need:

– To earmark $200 million to help elderly people without family support improve their home environment;

– To earmark $1 billion as a subsidy for the elderly in need to carry out maintenance or safety improvement works for their self-occupied properties;

– To conduct studies on how best to improve the Old Age Allowance Scheme and to reach a decision by the end of this year. The Government will provide each Old Age Allowance recipient with a one-off grant of $3,000;

– To increase funding by $60 million to provide additional places in day care centres, subvented homes and residential care homes for the elderly. To provide families and children with additional support:

To provide families and children with additional support:

– To provide funding of $45 million over the next three years to strengthen day foster care services and promote child care services;

– To provide additional funding of $40 million to strengthen support to victims of domestic violence and families in need. To support disabled people:

To support disabled people:

– To provide additional funding of $100 million to offer 300 more pre-school training places, 450 more day training places and 490 more subvented residential places;

– To make an additional provision of $35 million to establish 16 community support centres to strengthen services and support for disabled people as well as their family members and caretakers. To make provision of $1 billion in the next three years to create 3 000 three-year jobs for young people.

To make provision of $1 billion in the next three years to create 3 000 three-year jobs for young people. To set up four support services centres to provide interpretation services and language courses for members of ethnic minorities.

To set up four support services centres to provide interpretation services and language courses for members of ethnic minorities. To adjust the CSSA payment rates in accordance with the existing mechanism ahead of the normal schedule this year.

To adjust the CSSA payment rates in accordance with the existing mechanism ahead of the normal schedule this year. To provide one additional month of standard rate CSSA payments for CSSA recipients and one additional month of allowance for recipients of Disability Allowance. This proposal will involve an expenditure of about $1.2 billion.

To provide one additional month of standard rate CSSA payments for CSSA recipients and one additional month of allowance for recipients of Disability Allowance. This proposal will involve an expenditure of about $1.2 billion. To earmark $1 billion to pay for one-month's rent for lower income families living in public housing estates.

To earmark $1 billion to pay for one-month's rent for lower income families living in public housing estates.Leaving Wealth with the People and Sharing the Fruits of Prosperity

To lower the standard rate of salaries tax and personal assessment tax by one percentage point to 15%. This is reversion to the 2002-03 level and will cost the Government $960 million a year.

To lower the standard rate of salaries tax and personal assessment tax by one percentage point to 15%. This is reversion to the 2002-03 level and will cost the Government $960 million a year. To offer a one-off rebate of 75% of salaries tax and tax under personal assessment assessed for 2007-08, subject to a ceiling of $25,000. This will cost the Government $12.4 billion.

To offer a one-off rebate of 75% of salaries tax and tax under personal assessment assessed for 2007-08, subject to a ceiling of $25,000. This will cost the Government $12.4 billion. To raise the basic personal allowance and single parent allowance from $100,000 to $108,000 and to increase the married person's allowance from $200,000 to $216,000. All the major allowances will revert to their 2002-03 levels. The child allowance, allowance for dependent parent/ grandparent will be even higher than the 2002-03 levels. All these will cost the Government $1.31 billion.

To raise the basic personal allowance and single parent allowance from $100,000 to $108,000 and to increase the married person's allowance from $200,000 to $216,000. All the major allowances will revert to their 2002-03 levels. The child allowance, allowance for dependent parent/ grandparent will be even higher than the 2002-03 levels. All these will cost the Government $1.31 billion. To widen tax bands from $35,000 to $40,000, making them wider than those in 2002-03. This will cost the Government $1 billion.

To widen tax bands from $35,000 to $40,000, making them wider than those in 2002-03. This will cost the Government $1 billion. To lower the profits tax rate by one percentage point to 16.5%. This will cost the Government $4.4 billion a year.

To lower the profits tax rate by one percentage point to 16.5%. This will cost the Government $4.4 billion a year. To offer a one-off rebate of 75% of profits tax for 2007-08, subject to a ceiling of $25,000. This will cost the Government $1.73 billion.

To offer a one-off rebate of 75% of profits tax for 2007-08, subject to a ceiling of $25,000. This will cost the Government $1.73 billion. To waive business registration fees for 2008-09. This will cost the Government $1.6 billion.

To waive business registration fees for 2008-09. This will cost the Government $1.6 billion. To offer a one-off rebate of 75% of property tax for 2007-08, subject to a ceiling of $25,000. This will cost the Government $680 million.

To offer a one-off rebate of 75% of property tax for 2007-08, subject to a ceiling of $25,000. This will cost the Government $680 million. To waive rates for 2008-09, subject to a ceiling of $5,000 per quarter for each rateable tenement. This will cost the Government $11.2 billion.

To waive rates for 2008-09, subject to a ceiling of $5,000 per quarter for each rateable tenement. This will cost the Government $11.2 billion.

Providing for the Future To earmark $8.5 billion to provide people earning not more than $10,000 a month with a one-off injection of $6,000 into their MPF accounts.

To earmark $8.5 billion to provide people earning not more than $10,000 a month with a one-off injection of $6,000 into their MPF accounts. To earmark $50 billion from the fiscal reserves to promote healthcare reform.

To earmark $50 billion from the fiscal reserves to promote healthcare reform. -

This is truly a budget for the people, unlike some other government we know (who increase GST then using those accumulated money to give you money just enough for you to offset the increase 2%).

I doubt P4P can ever match the Hong Kong's budget even if they accumulate the benefits for 4 years.

-

What the difference between theirs and ours ? Perhaps ours gives to the undeserving like you and me.

-

Originally posted by kramnave:

What the difference between theirs and ours ? Perhaps ours gives to the undeserving like you and me.

If you think that is so, then there is really a problem with our government.

The Hong Kong government is genuinely interested in helping her citizens, look at the reserves they have and the handouts they are SHARING with the citizens.

Ours is alot like NKF management, they build up extremely huge reserves on the assumption of some doomsday calamity. Not forgetting paying themselves a big fat salary and bonus.

-

Hi TS,

how much do you know about things in hongkong huh? u just read read and soak in the words issit?? u ever lived in HK before anot...

-

Originally posted by udontknowme:

Hi TS,

how much do you know about things in hongkong huh? u just read read and soak in the words issit?? u ever lived in HK before anot...

Please read the headlined topic.I am just commenting on the budget, on how the caring Hong Kong government shares her surplus with her citizens.

Not comparing any other things.

I know that their public healthcare system for the citizens is maybe 1/3 or 1/4 the ones we pay at our "public" hospital.

Are you saying that the Hong Kong budget pales in comparison to our budget?

-

There is a problem. Can't deny that. Many of us don't care about the small amount of money and we don't benefit from workfare, don't benefit from education top ups, don't benefit from medicare top-ups, don't benefit from comcare etc why should they give us the money. Might as well take it from us and give more to the poor, the elderly, those who can feel the difference etc. Give to us for fark ? Not that the poor and elderly are more deserving of the money but at least they need it.

-

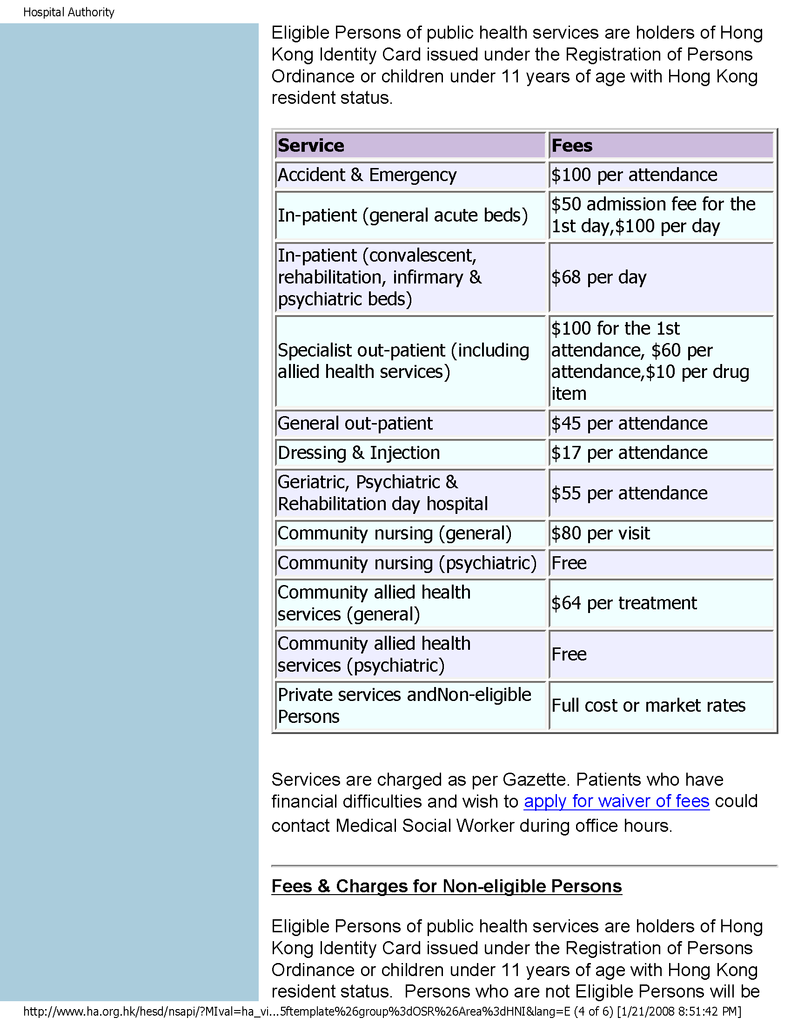

Charges are in Hong Kong Dollars. Makes you wonder what is P4P's definition of subsidies.

SG$ 1.00 = HK$ 5.55

A&E charges would be equivalent to SG$ 18.18, I wonder how much is Singapore's public hospital charges.

-

i dunno anything about singapore budget. mi dont care about singapore budget either. or course what u read LOOKS nice lar. where got pple so stupid will put something up that looks like shit one. u really think so caring meh? what makes u think it seems good even. u need to go to hongkong and live a while.

dunno what's with pple in singapore. readread info and soak it in only. but dunno anything else that's outside of what they read. and only know how to complain and whine that other places are so much better, get so much etc etc etc. but in reality, life in singapore is so much better than so many other places. tsk. so ignorant. never been to other places but wanna say life there is better. :roll:

i wasnt comparing. i was wondering what makes you think that what u read is so good. i was talking about Hongkong and hongkong oni. ur the one comparing, that's why you say it's good.

some pple oso bery stupid. earn money in singapore and go overseas for holiday. and come back and say that life in the country they went to is damn good because everything is cheap etc. but they must have conveniently forgotten about the bloody exchange rate and they also conveniently forgot to check how much the average person in that country earns.

-

not comparing HK's budget to SGPs', but that Ah Nay Finance Minister chap's reply in parliament today borders on arrogance and total disconnect with the reality on the ground.

Granted the what the MPs raised yesterday mostly lacked conviction on pushing for the case of the needy (u can tell by their monotony and reading from the notes), but to dismissed these appeals vigourously as he did today is painful to hear and watch.

that chap is definitely PM material.

-

Originally posted by udontknowme:

i dunno anything about singapore budget. mi dont care about singapore budget either. or course what u read LOOKS nice lar. where got pple so stupid will put something up that looks like shit one. u really think so caring meh? what makes u think it seems good even. u need to go to hongkong and live a while.

dunno what's with pple in singapore. readread info and soak it in only. but dunno anything else that's outside of what they read. and only know how to complain and whine that other places are so much better, get so much etc etc etc. but in reality, life in singapore is so much better than so many other places. tsk. so ignorant. never been to other places but wanna say life there is better. :roll:

i wasnt comparing. i was wondering what makes you think that what u read is so good. i was talking about Hongkong and hongkong oni. ur the one comparing, that's why you say it's good.

some pple oso bery stupid. earn money in singapore and go overseas for holiday. and come back and say that life in the country they went to is damn good because everything is cheap etc. but they must have conveniently forgotten about the bloody exchange rate and they also conveniently forgot to check how much the average person in that country earns.

Since you don't know anything about Singapore budget and don't care, obviously there is nothing to argue about since you don't know anything in the first place.

-

Originally posted by weiqimun:

not comparing HK's budget to SGPs', but that Ah Nay Finance Minister chap's reply in parliament today borders on arrogance and total disconnect with the reality on the ground.

Granted the what the MPs raised yesterday mostly lacked conviction on pushing for the case of the needy (u can tell by their monotony and reading from the notes), but to dismissed these appeals vigourously as he did today is painful to hear and watch.

that chap is definitely PM material.

I like it when all the P4P backbenchers agree in unison to anything that the Ministers put up.

Year in year out, they always praise the budget regardless of how punitive it is to the citizens.

I betcha, when they decide to raise the GST to 10%, all the Ministers and P4P backbenchers will applause and praise it as a budget with foresight.

What's the point of having so many P4P MPs and Ministers if they all agree with the PM, might as well just settle for PM and get rid of all the Ministers and MPs. Singapore will save alot on salaries every year.

-

I got to say though Hong Kong added gains from land sale into the budget and perhaps our government should do that too rather than stock it in our reserves. Our reserves are growing at an impressive rate and i believe we can still stand tall even though we are not a city in China (contrary to what the ignorant in other countries believe). Include the profits from land sales and spare me the pain of attempting to read the repetitive postings about it, albeit under different thread titles. Don't give to most undeserving Singaporeans, give it to the poor and the elderly who needs and appreciates it more than us, even though they may just be as undeserving. $100-$600 to us is rubbish, can be blasted on drinks in a day. Give to the $600 cleaner, its equivalent to his/her AWS.

-

you'll find hong kong a pretty amazing place, theres surprisingly alot of freedom in whatever sense even though we know its an SAR in china but hell its shocking.. theres enough money if you worked hard enough and the government happens to care more about the people than what they produce, which ironically, leads to higher productivity... and its be nice for once to at least see the gov break even or run a bloody deficit..

-

Originally posted by joshua182:

you'll find hong kong a pretty amazing place, theres surprisingly alot of freedom in whatever sense even though we know its an SAR in china but hell its shocking.. theres enough money if you worked hard enough and the government happens to care more about the people than what they produce, which ironically, leads to higher productivity... and its be nice for once to at least see the gov break even or run a bloody deficit..

In Singapore, the government also runs a deficit helping the people, but by next year when they have a revised previous year's budget, it will always show that the deficit which they intended to help the people turns out to be a surplus. Which is more like a joke than a budget.

It's like a look good kind of budget, they show you the figures and tell you crap, more like a can see but cannot touch budget.

It's like a look good kind of budget, they show you the figures and tell you crap, more like a can see but cannot touch budget.

When you treat your citizens like slaves and government as slave drivers, it will be counter productive for the economy as a whole.

-

btw the surplus is huge and if its put into perspective in scale against a country's size and population, anywhere else in the world the government would've been tossed right out for downright lying. made worse by the extreme ease of collecting data.

-

Hong KOng govt does not run the country like businessmen unlike bloody worse than vampires pap. Moreover, they did not implement any GST and still can do so well, bravo Hong Kong! Let's headhunt Ronald/Donald to take over ah qua lhl.

-

I roughly remember Hong Kong proposing a 5% GST to alleviate the burden on taxpayers. Plan was shelved after people took to the streets and protested.

-

http://www.hangseng.com/hsb/eng/mar/eu/hsem/m0105e.pdf

Read carefully.It come from Hang Seng Bank Research.Yes.The bank which created the Hang Seng Index which we come across everyday in the news abt HK stock.

1.It is too tedious to discuss the 2008/2009 budget.Have you huys know the following info:

A.During the past 10 years,to make the budgets looks great,HK gavaman sold lots of assets,like tunnels,ALL commercial centers(including all small and big shops )and carpark in public housing(like SG HDB) in HK etc.

This is window dressing like funds managers when the monthly report approcah!!

B.Stop hiring public servants for long time.

C.Lack of money to do what she need to do.

2.This may be sweeties for now,but it turn out to be poision for next generations.HK fiscal position is in danger.

Pl take note stamp duty from stock and property are HK 35 billion and 14.6 b respectively for 2007/08.Land sales is 63 b.

The surplus is some 110 b for 2007/08.How much surplus if the property and stock market and land sales cool down in 2008/2009?

Ths signs show is cooling down!!

Stock transactions drops from HK$165 b daily in Oct 2007 to HK$119 b in jan 2008!!

http://www.hkex.com.hk/markdata/markstat/mmdata.htm

3.read the daily value transacted in 2007 and Jan 2008 in HK EX.

http://www.hkex.com.hk/data/markstat/TV2007.htm

http://www.hkex.com.hk/data/markstat/TV2008.htm

.

-

Originally posted by maurizio13:

Since you don't know anything about Singapore budget and don't care, obviously there is nothing to argue about since you don't know anything in the first place.

well at least this guy got the guts to say that he did know about Singapore. Do you know HK? no guts to say huhh...

-

The followings are some of the assets sales of HK government as quoted in Hang Seng Report i posted ealier today:

I think i need to remind u the sales of ALL commercial spaces and carpark in public housing in HK!!The deal was done !!

Moreover, this year’s (HK)government revenue will

derive an estimated HKD17 billion from the sales/

securitisation of government assets. So far, the

government has issued a HKD6 billion Toll Revenue

Bond backed by the toll revenues of five tunnels

and one bridge. However, the government needs to

raise a further HKD11 billion to meet its target this

year. But,..

A question arises: Could the(HK) government rely on

surplus from capital revenue, comprising mainly

land premiums and sales proceeds of government

assets, to plug the hole of the operating deficit?

1.SG is also facing primary deficit,thats deficits after Operating and capital revenues less Operating and capital expenditures.

But SG ,like HK,inject funds from Net Investment to make the budget in surplus

after injection.

I read from report of TODAY,a paper by GIS Real Estate head,states that SG revenue is declining in GDP term.Therefore it is damn important to look for investment return.

Pl share this report or article here or in separate thread.

2.SG has not depended on capital revenues,like land sales and sales of assets to window dress the budgets.In fact,the injections of more $$ from GIC and Temasek can make the budgets very nice looking every year.We have never done this trick.

we have to think of future generations!!

-

Ming Pao,a Chinese daily in HK for more educated readers,against too much sweeties:

派錢豪情è´�掌è�² 收窄稅基留後患 (æ˜Žå ±) 02月 28æ—¥ 星期四 05:05AMhttp://hk.news.yahoo.com/080227/12/2plwo.html

ã€�æ˜Žå ±å°ˆè¨Šã€‘è²¡æ”¿å�¸ 長曾俊è�¯ 在其首份財政é �算案ä¸ï¼ŒæŠŠæœ¬è²¡æ”¿å¹´åº¦çš„1156億元巨é¡�盈餘,悉數以多種方å¼�回饋市民(包括é �æ’¥500億元作為推動醫療改é�©ä¹‹ç”¨ï¼‰ï¼Œé€™å‰¯æ´¾éŒ¢è±ªæƒ…,眼å‰�當會è´�得掌è�²ï¼›ä½†

是這份é �算案ä¸�å¿…è¦�地收窄稅基,使本港的稅基狹窄的çµ�構性å•�題更趨惡化,這種å�šæ³•æ˜¯éŒ¯çš„。å�¦å¤–é �算案缺ä¹�解決一些急需處ç�†é›£é¡Œçš„è¦�劃,也是其ä¸�足之處。

本財政年度由於股市交投暢旺,賣地æˆ�績ç�†æƒ³ï¼Œå‰µä¸‹æ·ä¾†æœ€å¤šçš„ 1156億元盈餘,政府以本港經濟低迷期間,市民與政府å�ŒèˆŸå…±æ¿Ÿã€�共渡時艱,ç�¾åœ¨è²¡æ”¿æƒ…「喜出望外ã€�的好為由,回饋市民,使大家分享經濟æˆ�果,是應有之義;而且曾俊è�¯çš„派錢措施,大多數是一次é�Žæ–¹å¼�,長é� 而言,å°�於公共財政ä¸�致構æˆ�é•·æœŸè² æ“”ï¼Œå› æ¤æ˜¯å�¯ä»¥æŽ¥å�—的。

曾俊è�¯é€™æ¬¡æ•£è²¡ï¼Œæœ‰ä»¥ä¸‹ä¸€äº›ç‰¹é»žï¹•ï¼ˆ1)å�„個階層一網打盡,由低收入人士和家åºã€�ä¸ç”¢éšŽå±¤ä»¥è‡³å�šç”Ÿæ„�的富商巨賈,都å�—æƒ ã€‚ï¼ˆ2)慷慨程度超乎é �期,例如政府ä¸�å±ˆå¾žæ”¿é»¨çš„å£“åŠ›ï¼Œå …æŒ�ä¸�åŠ ç”Ÿæžœé‡‘ï¼Œä½†æ˜¯å�»ä¸€æ¬¡é�Žçµ¦é•·è€…發放多é�”3000元的津貼,數é¡�之高,出乎許多人æ„�料之外。(3)派錢有新æ„�,例如給約240è�¬å€‹é›»åŠ›ç”¨æˆ¶è£œè²¼1800元電費ã€�給月薪1è�¬å…ƒæˆ–以下打工仔的強ç©�金 戶å�£æ³¨å…¥6000å…ƒç‰ï¼Œéƒ½å…·å‰µæ„�。å�¦å¤–是派錢方å¼�é�¿å…�刺激已經冒å�‡çš„通脹,例如退稅是以下一年度扣稅來兌ç�¾ï¼Œè€Œé�žå¯„上支票鼓勵å�³æ™‚消費;公屋ä½�戶å…�租1個月;減å…�å››å£å·®é¤‰ ç‰ï¼Œéƒ½æ˜¯å�¯ä»¥æ‹‰ä½Žé€šè„¹çŽ‡çš„å�šæ³•ã€‚å› æ¤é€™æ¬¡å›žé¥‹å¸‚民,顯見心æ€�。

明知稅基�窄,為何�收窄?

ä¸�é�Žæ›¾ä¿Šè�¯é€™æ¬¡æ´¾éŒ¢ï¼Œæœ‰äº›åœ°æ–¹æ´¾é�Žäº†é ï¼Œä»¤æœ¬ä¾†å·²ç¶“ç‹¹çª„çš„ç¨…åŸºï¼Œæ›´åŠ æƒ¡åŒ–ã€‚ä¾‹å¦‚è–ªä¿¸ç¨…çš„å…�稅é¡�和擴闊稅階,本來回復到2002/03年度水平,稅基已經收窄,ç�¾åœ¨æ›¾ä¿Šè�¯çš„建è°æ›´ç‚ºå¯¬å¤§ï¼Œæ¤èˆ‰ä½¿ç´„9.7è�¬å��ç´�稅人脫離稅網。薪俸稅是政府財政收入的主è¦�來æº�之一,å†�å°‘äº†é€™éº¼å¤šäººäº¤ç¨…ï¼Œç¨…å‹™è² æ“”æ›´åŠ å�‘å°‘æ•¸äººå‚¾æ–œï¼Œç¨…è³¦æ‡‰è©²ç”±æœ€å¤šçš„äººè² æ“”çš„åŽŸå‰‡ï¼Œæ›´åŠ æœªèƒ½å¾—åˆ°é«”èª�。

酒店房租稅也ä¸�應è±�å…�ï¼Œå› ç‚ºå½±éŸ¿æˆ¿ç§Ÿé«˜ä½Žçš„é—œé�µå› ç´ ï¼Œæ˜¯é…’åº—æˆ¿é–“èˆ‡é�Šå®¢æ•¸é‡�的供求關係。政府下年度在勾地表æ��ä¾›10幅土地,é™�作酒店之用,已經是輔助酒店æ¥ç™¼å±•ï¼Œé…’åº—æˆ¿é–“å¢žåŠ æ›´æœ‰åˆ©æ–¼ç´“ç·©æˆ¿ç§Ÿä¸Šå�‡çš„壓力;而且,è±�å…�房租稅之後,酒店æ¥è€…會å�¦æ¸›ä½Žæˆ¿ç§Ÿï¼Œä½¿æ—…客得益,令人懷疑;如果減了稅而需求還是一樣殷切,房租ä»�æœƒå¢žåŠ ã€‚å°�香港而言,è±�å…�了這個稅種,稅基å�»å�³æ™‚進一æ¥æ”¶çª„了。

這些年來,政府一直謀求擴闊稅基,昨日曾俊è�¯ä¹Ÿå†�三強調政府會開展例如商å“�æœ�務稅,甚至環ä¿�稅ã€�奢侈稅ç‰æ–°ç¨…ç¨®çš„ç ”ç©¶å’Œè«®è©¢ï¼Œä½†ä»¥æœ¬æ¸¯ç›®å‰�的政治環境,è¦�尋求社會共è˜é–‹è¨æ–°ç¨…ç¨®ï¼Œæ¥µå…¶å›°é›£ï¼Œå› æ¤ç›¡é‡�ä¿�ç•™ç�¾æœ‰ç¨…種,確ä¿�稅基ä¸�致收窄,å��分é‡�è¦�,但是曾俊è�¯åœ¨é �算案的建è°ï¼Œå�»æ˜¯å��å…¶é�“而行,令人費解。

處女作å�Šæ ¼ï¼Œä½†é�žä¸Šä¹˜ä¹‹ä½œ

å�¦å¤–,é �算案æ��到就10號貨櫃碼é 在é�’è¡£å�—興建和興建第三æ¢�æ©Ÿå ´è·‘é�“,開展環評ç‰ç ”究,較令人詫異。關於10號貨櫃碼é ,其實隨覑內地多處(包括深圳 ã€�上海 ç‰æ¸¯å�£ï¼‰è™•ç�†è²¨æ«ƒçš„å�žå��é‡�連年以雙ä½�數å—增長,本港這方é�¢çš„增長已經顯得甚為緩慢,興建10號貨櫃碼é è°è€Œä¸�決多年,好åƒ�已經沒有需è¦�,政府é�ŽåŽ»èˆ‡å…§åœ°å•†è°å�”調å�ˆä½œç™¼å±•ï¼Œä¸€è²«èª�為ä¸�應該é‡�複興建基礎è¨æ–½ï¼Œä»¥å…�浪費,ç�¾åœ¨10號貨櫃碼é é‡�新上馬,是å�¦é¡¯ç¤ºæƒ…î€‡æœ‰æ‰€è½‰è®Šï¼Œæ”¿åºœå®œå…¬å¸ƒè³‡æ–™ä¾›å…¬æ³·ç ”è°è¨Žè«–。

至於第三æ¢�è·‘é�“,據知é�ŽåŽ»æœ‰é—œç•¶å±€æ›¾ä½œç ”究,èª�為未符æˆ�æœ¬æ•ˆç›Šï¼Œå› æ¤æ‰�æœƒå°‹æ±‚èˆ‡æ·±åœ³æ©Ÿå ´å•†è¨Žï¼Œè¦�盡快興建一æ¢�é�µè·¯ï¼Œé€£æŽ¥èµ¤èº¹è§’æ©Ÿå ´å’Œæ·±åœ³æ©Ÿå ´ï¼Œå¯¦è¡Œåˆ†å·¥å�ˆä½œï¼Œç�¾åœ¨æƒ…是å�¦æœ‰è®Šï¼Œå…¬æ³·ä¹Ÿéœ€è¦�è¶³å¤ è³‡æ–™ç ”è°ã€‚

上述兩個è¦�劃令人感到詫異,但是眼å‰�需è¦�è§£æ±ºçš„å±•è¦½å ´åœ°ä¸�足å•�題,é �算案å�»ä¸€å—未æ��。本港會展æ¥é�到澳門 挑戰,已經是ç�¾å¯¦ï¼Œæ¤å¤–廣州甚至æ�±èŽžç‰ç� 三角 地å�€çš„一些展覽è¨æ–½çš„è¦�模,都大é�Žæœ¬æ¸¯ï¼Œè²¿æ˜“發展局已經æ��出所é�¢å°�挑戰和å¨�脅,但是未見政府ç©�極æ£è¦–。

曾俊è�¯çš„首份é �算案,雖然在派錢方é�¢è´�得掌è�²ï¼Œä½†æ˜¯åœ¨ç¨…基未擴闊,å��而有所收窄,而在解決本港一些çµ�構性å•�題方é�¢äº¤ç™½å�·ã€‚å› æ¤ä»–給香港ç�†è²¡çš„é 一炮,充其é‡�é«”ç�¾äº†æœ‰éŒ¢å¥½è¾¦äº‹ï¼Œä½†æ˜¯æœ¬æ¸¯éœ€è¦�的大擘劃,除了準備500億元作醫療改é�©ç”¨é€”,ç¨�è¦‹æ‰¿æ“”ä¹‹å¤–ï¼Œå…¶ä»–æ¬ å¥‰ï¼Œæ‰€ä»¥é€™ä»½é �算案雖然é�Žé—œå�Šæ ¼ï¼Œä½†é�žä¸Šä¹˜ä¹‹ä½œã€‚

2.The poor HK government sold approximately 1,015,000 square metres of retail space and 80,000 carpark spaces to http://www.thelinkreit.com/en/corp/overview.asp.

http://www.housingauthority.gov.hk/en/commercial/0,,,00.html

HK is selling forefather asstets to support living.

-

Originally posted by lionnoisy:

Ming Pao,a Chinese daily in HK for more educated readers,against too much sweeties:

2.The poor HK government sold approximately 1,015,000 square metres of retail space and 80,000 carpark spaces to http://www.thelinkreit.com/en/corp/overview.asp.

http://www.housingauthority.gov.hk/en/commercial/0,,,00.html

HK is selling forefather asstets to support living.

Like how we sell our lands to foreigners and keep it in our extremely huge reserves like NKF?

At least Hong Kong government redistribute all her surplus to the citizens.

-

Maybe it's high time that our Ministers go over to Hong Kong and learn from their counterparts on, how to manage a country of the people for the people. Not to exploit it for selfish personal gains.

-

Needless to say...