Hong Kong's budget is truly for the people, unlike..........

-

well i guess we can go on and speculate where does the money kept in the reserves go to but the intention sounds logical and that is to keep excellent reserves. You can give away everything and run the risk of low reserves - when a credit crunch or when SARs or when Chicken Flu hits - you need money from the reserves to ensure that the economy is minimally hit. - this is of cos an option - make the people happy now and if nothing happens, great!

The other option is what Singapore took - be more cautious - keep a huge reserves - maybe the people will not be 100% happy - maybe just 50% happy but when a crisis happens, we will have money to still keep people happy enough. I believe, no matter how much i criticise the government, we are one of the few countries whose economy is not seriously crippled when SARs and Chicken Flu hits...where does the money come from? Comes from us of cos but at least well used by them in times of crisis.

Well thats my opinion anyway, i guess no one will can be fully pleased.

-

Originally posted by gasband:

well i guess we can go on and speculate where does the money kept in the reserves go to but the intention sounds logical and that is to keep excellent reserves. You can give away everything and run the risk of low reserves - when a credit crunch or when SARs or when Chicken Flu hits - you need money from the reserves to ensure that the economy is minimally hit. - this is of cos an option - make the people happy now and if nothing happens, great!

The other option is what Singapore took - be more cautious - keep a huge reserves - maybe the people will not be 100% happy - maybe just 50% happy but when a crisis happens, we will have money to still keep people happy enough. I believe, no matter how much i criticise the government, we are one of the few countries whose economy is not seriously crippled when SARs and Chicken Flu hits...where does the money come from? Comes from us of cos but at least well used by them in times of crisis.

Well thats my opinion anyway, i guess no one will can be fully pleased.

Having reserves is good, but having an excessive reserve like those of NKF is bad, all Durai could ever think about was exploiting those reserves for his own personal benefits, such as having solid gold taps, washbasins, etc., taking flights in first class airlines and living in first class hotels. Finally all the donations from hard earned savings from donors that trickled down to kidney patients was only $0.10 per dollar.

Are you that naive to think that the government will actually dig into it's deep pockets to help Singaporeans if SARS or Chicken Flu were to hit Singapore?

We have a case history of SARS? How much was used to help stabilised the economy (like what you purport to say)?

We had a Bird Flu situation in Malaysia afew years back, where poultry and eggs was banned from Malaysia and prices skyrocketed.

How much of this so called reserves were used to stabilise the prices of eggs? Eggs before the crisis was around $0.15, subsequently skyrocketed to $0.50 to $0.60.

Maybe some doomsday event did occur in Singapore and our beloved P4P government did dig into it's deep pocket to help those victims.

Could you name any such events? Surely there must be at least one event through your years of existence.

Everyday you hear of foreclosures of HDB due to homeowners inability to make payments. Lately there was a case of 7 household members being forced to lived in the void decks. How much did the government dig into it's coffers to help these people?

-

i have relatives in hk and they say that, as nice as the budget looks, quite of lot of people arent happy about hk's budget they are all complaining... much like most singaporeans

-

Originally posted by aiglosicicle:

i have relatives in hk and they say that, as nice as the budget looks, quite of lot of people arent happy about hk's budget they are all complaining... much like most singaporeans

hehehe.....then it will be worse if they ever come Singapore, they will protest in the streets.

wait a minute i forgot Singapore doesn't allow protest like Hong Kong.

-

hurhurhurhur as i said, i have my opinions, you may be right, you may be wrong. But I am happy here...if you are not, you can always DO something about it.

-

Originally posted by lotus999:

lionnoisy,

nobody is saying gst is good or bad. the argument here is that our gahmen appeared to be sneaky in deliberating making negative projection for its budget so that it could increase gst on us.

btw, gst has got nothing to do with pension fund.

too much of research apparently isn't doing you good. you become confused and distracted.

can SG gahmen foresee the crazy property and stock markets in Feb 2007!!Few can foresee futures!!

Remember HK also under estimate surplus by few times!!It is normal!!

-

Originally posted by aiglosicicle:

i have relatives in hk and they say that, as nice as the budget looks, quite of lot of people arent happy about hk's budget they are all complaining... much like most singaporeans

I believe Maurizio13 doesnt really have a clue about what he is saying and he is just googling and making up stories as we go along.As you can see, he is bringing in NKF and Durai into this discussion now... hehehe.

-

i do not think that SG reserve is excessively huge in terms of todays global market. I believe SG trade is 3 or 4 times that of sg domestics consumption. So SG is always influence by outside, remember the 97 financial sell off cris the reserved is only a small pcs of defence against throwing SG $ out the window. So i think need to look at relative terms of consideration in the global financial enviornment rather than comparing in domestics issue.

Does HKG have that worried ? I wonder, Beijing will always be there. the only worried will be the Governor of HKG getting fired by Beijing if he screwed up.

-

Originally posted by Arapahoe:

i do not think that SG reserve is excessively huge in terms of todays global market. I believe SG trade is 3 or 4 times that of sg domestics consumption. So SG is always influence by outside, remember the 97 financial sell off cris the reserved is only a small pcs of defence against throwing SG $ out the window. So i think need to look at relative terms of consideration in the global financial enviornment rather than comparing in domestics issue.

Does HKG have that worried ? I wonder, Beijing will always be there. the only worried will be the Governor of HKG getting fired by Beijing if he screwed up.

HK has a captive market and that is CHINA. So there there is really nothing much to worry about. really.

-

is no one else disturbed by the fact that the budget had such a huge surplus?

If that's not evidence that HK's budgeting is bad, I don't know what is. I don't see why people are thinking it's a gold star for HK. This is BAD.

And please, before you site cases of the occasional homeless family, please look back at what you're comparing with. You want to compare SG to HK, take a look at how many homeless families they have THERE.

-

Originally posted by deathbait:

is no one else disturbed by the fact that the budget had such a huge surplus?

If that's not evidence that HK's budgeting is bad, I don't know what is. I don't see why people are thinking it's a gold star for HK. This is BAD.

And please, before you site cases of the occasional homeless family, please look back at what you're comparing with. You want to compare SG to HK, take a look at how many homeless families they have THERE.

You can also compare the condition of their public housing

-

Originally posted by TCH05:

I believe Maurizio13 doesnt really have a clue about what he is saying and he is just googling and making up stories as we go along.As you can see, he is bringing in NKF and Durai into this discussion now... hehehe.

Maybe you can rebutt my points instead of mere criticism.

-

Originally posted by TCH05:

You can also compare the condition of their public housing

From a previous post:

Salary Expectations

A recent graduate can expect between US$20,000 to US$31,000 per year. Chinese New Year bonuses in the amount of one month's salary are given by most employers at the end of January or beginning of February. Most companies pay in Hong Kong dollars and salaries are often quoted in HK$ per month. When negotiating a salary in Hong Kong it is important to make sure both sides know which currency is being discussed.

http://www.amcham.org.hk/hongkong/employment.html#cost

Median household monthly income in the third quarter grew to HKD 16,700, up 4.4% on the same period last year, while the median individual monthly salary rose 2% to HKD 10,000.

http://www.news.gov.hk/en/category/businessandfinance/061123/html/061123en03002.htm

Average household income is HKD 18,884 and 30.6% (HKD 5,779) goes to housing.

http://www.censtatd.gov.hk/hong_kong_statistics/statistical_tables/index.jsp?charsetID=1&tableID=54B

Average cost of 61.6 sq.m apartment = HKD 1,000,000

http://www.housingauthority.gov.hk/en/aboutus/news/pressreleases/0,,2-0-15512--0,00.html

Time required for an average household to purchase apartment in Hong Kong:

(HKD 1,000,000 / HKD 5,779) / 12 months = 14.42 years

====================================================

Average household income is SGD SGD 3,244 and 22.4% (SGD 727) goes to housing.

http://www.singstat.gov.sg/pdtsvc/pubn/softcopy/hes2003.pdf

Average cost of 3 room HDB apartment in Singapore = SGD 170,000

Time required for an average household to purchase an apartment in Singapore:

(SGD 170,000 / SGD 727) / 12 months = 19.49 years.

====================================================

Conclusion: an average Singaporean would take 5 years longer than their Hong Kong counterparts to finish paying off their housing loan.

Have you the faintest idea what is "reserves" in Singapore context? Where does the reserves come from? Do you know what is happening to OUR reserves now? Having a budget deficit once or a few times in a while is not the end of the world, it gives the economy time to restructure and focus on areas of development (instead of seeing your fellow citizens ending up on the MRT tracks as roadkill, in this case, track kill). Business cycles is not a linear line, it goes up it comes down, it's cyclical.

Have you analyse their budget 2006/2007? To increase taxes so that you can spend on areas to help stimulate the economy is one thing, increasing taxes so that you can have a bigger pay is another. In economics, it's called "Moral Hazard", a situation in which one of the parties to a contract has an incentive, after the contract is agreed, to act in a manner that brings benefits to himself at the expense of the other party to the contract.

In corporate finance, it's not good to have too much reserves, because it lowers your Return on Equity (ROE). That's why Singtel decided on a share buyback to reduce it's reserves, because they can't make that rate of return expected from them by the market. e.g. There is a difference between making a $10 profit with $200 and $100. $200: ROE = 5%; $100: ROE = 10%.

Do you know that the recent depreciation, since mid 2004 has resulted in a loss of 10% of our reserves? I would not discount a 15% to 20% loss of our reserves in afew years time.

[(1.71 - 1.54) / 1.71] X 100% = 9.94%

Why did such loss occur? A rigid system like ours will lead to more problems, because of it's inability to react to external circumstances with an appropriate response. Having 82 "Yes Sir!" people in the cabinet is not going to yield dynamic change.

You don't have to go Hong Kong to ask them about their lives, you ask me or any average Singaporean and they will tell you their lives.

According to "the Economist: world in figures 2007", Hong Kong's purchasing power is ranked 15th (77.7), whereas Singapore is ranked 24th (70.8 ); (USA = 100)

I admire you, you get all your information from ChannelNewsAsia, you are one smart aleck. Judging yourself in the mirror, you will always look perfect. But having others judge you is impartial. -

A post from I-like-flings(m), who currently resides in Hong Kong (replies are in red):

Originally posted by lionnoisy:

The grass is not so green in HK!!Well done maurizio1!!Good research.

2.The grass is not so green in HK!!

[b]HK housing is so expensive

Yes it's the most expensive thing in hk already.. beside that not alot is more ex then singapore lor...

Average cost of public housing 61.6 sq.m apartment = HKD 1,000,000

is in remote area of TIN SHUI WAI.

hong kong map and click 12

TIN SHUI WAI ,some 30 km from CBD,is famous for family tradegy in public housing.

not only in tin shui wai lah...it's not so ulu ulu lah.. in tai po.. u can get a fcuking small flat at HKD 600K only.. 1M? also got lah.. it take 30 to 45 min to get to tst or wanchai or central.. about the same time i need to get to orchard from jurong..

in WONG TAI SIN and SHA TIN,It cost S$200,000 for a 40 to 50 m2 public housing flat and S$360,000 for 55 to 60m2 .Both are considered convenient to CBD.

3.For private built housing like CITY ONE SHATIN,20 years old,lease up to year 2047.

a so called 395 sf,,but net area some 28m2 costHK$1.14m or S$220,000

a so called 562 sf,but net area 40m2,cost HK$1.90m or S$380,000.

u know why it's up to 2047? cos that is the 50yrs period as SAR after 1997 lah. if it's still an SAR after that. it will be renew lah..so most private housing is freehold one or 999 yr.. not like sg 99 yrs lah..

Therefore it take 26 years for HK pple to buy a 40m2 public housing near CBD ,like Wong Tai Sin and Sha Tin (1,800,000 /5774)/12

Pl verify my words from private sales transaction in HK

for info about half of housing in HK is private built .Most of the other half

is for rental from goverment.

yes.. so what u are comparing are their private housing vs our public housing..so what u think?.. for their government housing.. it's cheap and it's not all that small.. if they got a big family... they will be given bigger flat...

Interest rates

4.HK mortgage interest rates in July already above 5 %!!

http://hk.news.yahoo.com/060719/318/1qayk.html

one % of interest rate will kill u!!

HK income tax paid in one lump sum and is paid in advance,ie

your next year income is estimated and pay in this year!!

do u know sg is talking about it already?? sg is even talking about earn as u pay scheme.. which mean like cpf u wont get to see ur money ever.. just ur first yr u will pay double.. after that it's back to normal already

therefore HK is very common to borrow

Salaries Tax Loan pl read under LOANS of Consumer Banking.

Lot of people have to borrow fr loan shark to pay income tax.

Dunt take monthly instalemt and interest free income tax for granted.

5.Pl assess a place as package,like Set Menu.[/b]yes and after assess the hk package i am still fcuking happy to pay my HKD60K tax in coming jan ok... at least i only pay HKD1K for cpf nia...

-

Originally posted by maurizio13:

Since you don't understand, then I will elaborate further.Singapore has defence spending expense and GST revenue. They more or less cancel each other out.

Singapore's GST revenue for 2008 is going to approximate to $6 billion to $7 billion.

Hong Kong does not have this defence spending and GST revenue. Equates to zero.

You still have problems understanding?

Anybody else have problems understanding?

2% GST will bring in S$1.5 Billion, total GST bring in S$5.5 Billion.

Singapore defence budget is S$10.5 Billion.

Do you understand what's wrong in your calculation?

-

Originally posted by sgdiehard:

2% GST will bring in S$1.5 Billion, total GST bring in S$5.5 Billion.

Singapore defence budget is S$10.5 Billion.

Do you understand what's wrong in your calculation?

Huh?Hong Kong does not have GST 0%.

Singapore has GST which is going to be $6 billion (2007) to $7 billion this year.

You are comparing no GST with 7% GST, NOT 5% GST with 7% GST.

Quite obviously you are quantitatively challenged, either that or you trying to distort facts

and figures to twist your way out of truth.

$5 billion is more than enough for a small country's defence budget.

If Singapore decides to spend $100 billion on defence, is that going to be a global standard?

Singapore's defence budget is too excessive, Taiwan (a much bigger country) preparing for war with China has a defence budget of $7.9 billion,

while Singapore a small dot has $5.6 billion during peace time.

Isn't this disproportionate?

-

Originally posted by maurizio13:

From a previous post:

http://www.news.gov.hk/en/category/businessandfinance/061123/html/061123en03002.htm

Average household income is HKD 18,884 and 30.6% (HKD 5,779) goes to housing.

http://www.censtatd.gov.hk/hong_kong_statistics/statistical_tables/index.jsp?charsetID=1&tableID=54B

Average cost of 61.6 sq.m apartment = HKD 1,000,000

http://www.housingauthority.gov.hk/en/aboutus/news/pressreleases/0,,2-0-15512--0,00.html

Time required for an average household to purchase apartment in Hong Kong:

(HKD 1,000,000 / HKD 5,779) / 12 months = 14.42 years

====================================================

.............

Oh no such Frogs jumping in HK!!How can u use the subsidy rent to calculate selling prices??

fr this u can see even a former public housing ,

in a remote location in Tin Shui Wai,Yuen Long ,NT,estate selling at $1700 psf at gross floor area.

HK is still using gross floor area and u have to discount 20 to 30 % to get the net floor area.

or tell me where u can get a 62 m2 net floor area at HK$1 million??

http://web.centanet.com/findproperty/

2.BTW ,HK has been stop selling public housing for some times to protect the crash of property market!!

-

Originally posted by lionnoisy:

Oh no such Frogs jumping in HK!!How can u use the subsidy rent to calculate selling prices??

fr this u can see even a former public housing ,

in a remote location in Tin Shui Wai,Yuen Long ,NT,estate selling at $1700 psf at gross floor area.

HK is still using gross floor area and u have to discount 20 to 30 % to get the net floor area.

or tell me where u can get a 62 m2 net floor area at HK$1 million??

http://web.centanet.com/findproperty/

2.BTW ,HK has been stop selling public housing for some times to protect the crash of property market!!

Huh? Since when I used rent subsidy to calculate housing prices?

Do you mean that since Singapore's public housing is subsidise, so we shouldn't compare with Hong Kong's subsidised public housing?

These are the prices paid by citizens in Hong Kong and Singapore.

Ok. Finally understood your point. You meant I used the housing statistic from Hong Kong census to calculate repayment period for mortgages.

Obviously the "rent" housing there meant what Hong Konger's spend on housing, else there would be no expenses for housing.

It's an annual census, so obviously not everyone rents an apartment (some purchase while others rent), it's the amount the Hong Kongers spend on housing.

If you have a better statistical amount from the census on the Hong Konger's spend on housing, please share then, because that is the amount that

Hong Konger's spend on housing in a census conducted by the Hong Kong government.

I do try my best to present my data objectively and not try to distort figures (like others, I shall not mention names) by comparing public housing with private housing.

Another flaw in your argument being, I used "rents" to calculate mortgage payments, if you consider that the usage of rental subsidy to make payments to mortgages is too unfair. Then maybe I should use another figure higher than the "rentals subsidy", therefore shortening the repayment period for the mortgage for public housing in Hong Kong. Generally, rentals are smaller in amount than mortgage repayments.

I like the way you shoot yourself in the foot without even realising it.

Funny how you compare Hong Kong's public housing with Hong Kong's private housing.

Are you asking me to compare Hong Kong's private housing with Singapore's public housing?

Your link in (2) is non-existent.

-

noisy,

noisy,You will never cease to be an amusement to me with your antics.

Argue with objective data and clear logic.

When you get too involved with supporting P4P, you end up arguing in every aspect just to support P4P and

put them in a good light, you will fail in all the points of your arguments.

-

Originally posted by maurizio13:

Huh?Hong Kong does not have GST 0%.

Singapore has GST which is going to be $6 billion (2007) to $7 billion this year.

You are comparing no GST with 7% GST, NOT 5% GST with 7% GST.

Quite obviously you are quantitatively challenged, either that or you trying to distort facts

and figures to twist your way out of truth.

$5 billion is more than enough for a small country's defence budget.

If Singapore decides to spend $100 billion on defence, is that going to be a global standard?

Singapore's defence budget is too excessive, Taiwan (a much bigger country) preparing for war with China has a defence budget of $7.9 billion,

while Singapore a small dot has $5.6 billion during peace time.

Isn't this disproportionate?

Budget 2008 GST Revenue is 6.19 billion. Defence Expenditure is 10.473 billion.check it out and don't use outdated figures in your argument. Not all these cut and paste from the websites are relevant, it ruins your credibility in your argument, you haven't got much in the first place.

is $5 billion more than enough for a small country's defence budget? Talk to me when you are defence minister.

-

Originally posted by sgdiehard:

Budget 2008 GST Revenue is 6.19 billion. Defence Expenditure is 10.473 billion.check it out and don't use outdated figures in your argument. Not all these cut and paste from the websites are relevant, it ruins your credibility in your argument, you haven't got much in the first place.

is $5 billion more than enough for a small country's defence budget? Talk to me when you are defence minister.

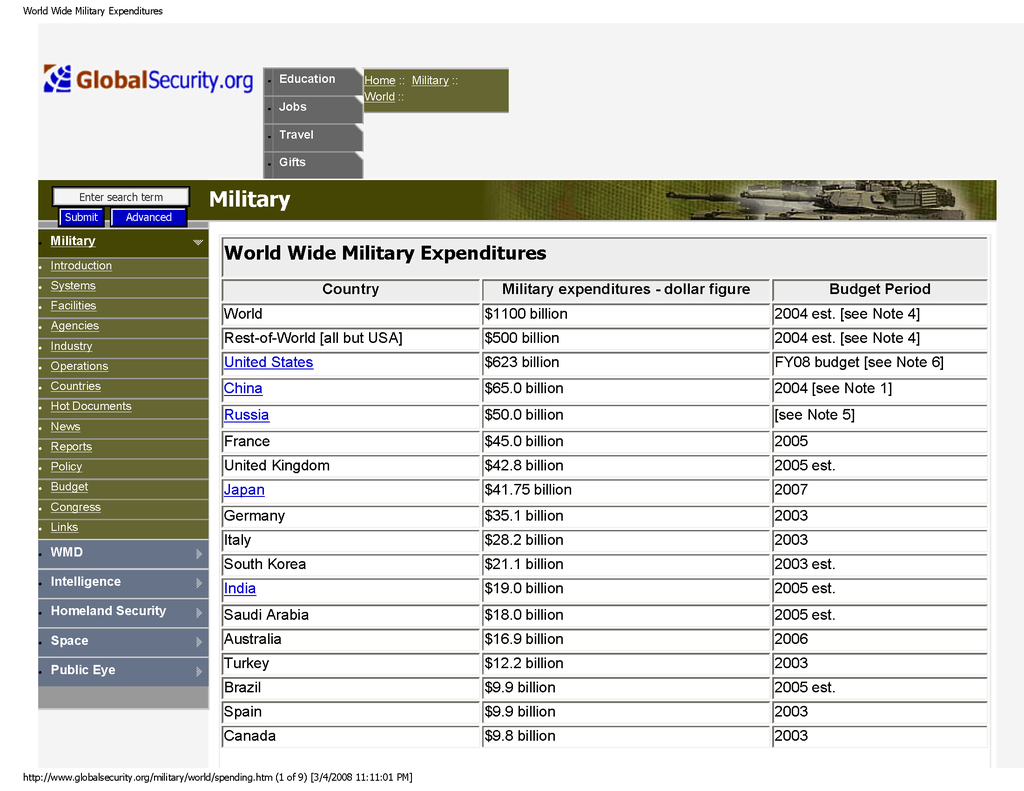

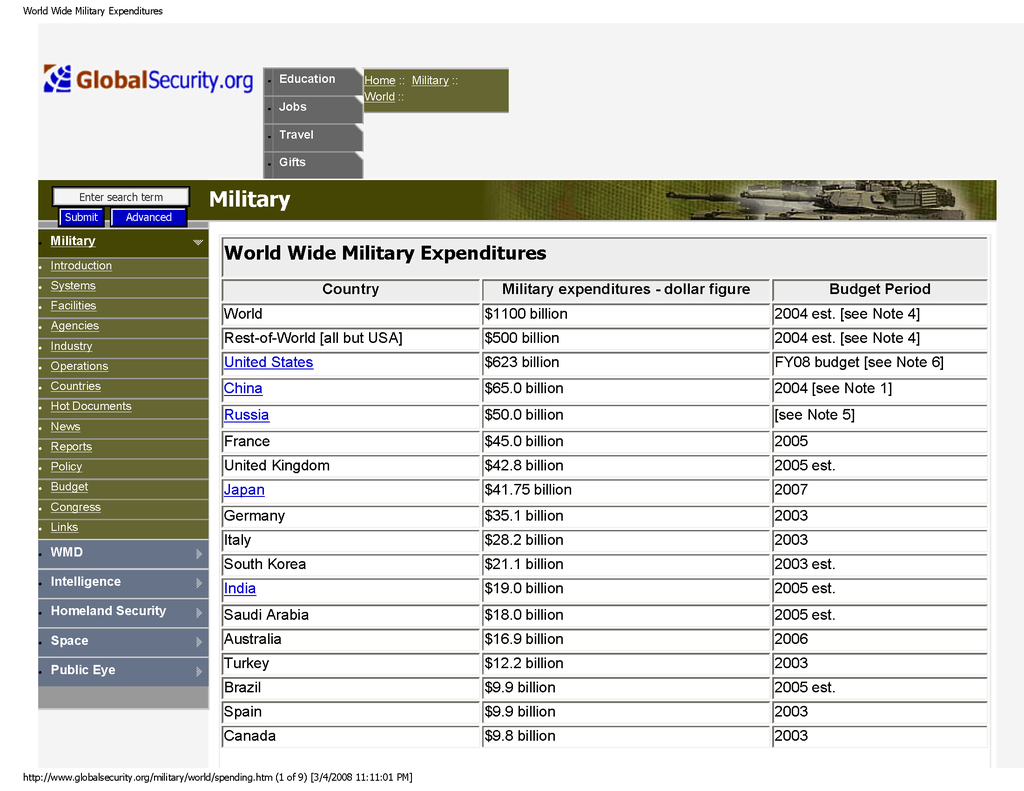

Whatever they decide to spend on Defence is their discretion, they can spend $100 billion on defence, but does that mean that all the other countries will follow.The figures from Global Security is from 2005, it's what some countries around the world spend on defence.

It not used to state that it's our budget for the year 2008, it's already stated 2005 in the report.

I used the compilation to show what other bigger countries are spending in defence around the world.

You mean to tell me $6 billion is not enough for a small country to spend on defence?

Maybe you should read the list of countries with less than $6 billion budget on defence.

Sweden, Norway, Denmark, Belgium and Switzerland.

Maybe the Minister of Defence for those countries are not as smart as you.

What are you working as now?

With regards to your accentuation on our inflated defence budget, I have only this remark to add.

After spending $10.5 billion in our defence forces, we can't even catch a soon to be 50 year old limping uncle (Singapore's No.1 Suspect Terrorist Mas Selamat Kastari).

How does that make you feel?

Was the money well spent?

-

ok ok lets go back to the ground,

poor HK pple stay in half of the size of the flat u can buy in SG with same prcie!!

AND U GUYS SAY HK GAVAMAN CARE FOR HER PPLE!!

to be fair,it is a record price in SHATIN,about 30 to 45 mins MTR ride to CBD like Mongkok and Central.

In Shatin,a 45 meter flat of 5 year old(like HDB resale flat) sold for 1.65million HK $$!!or S$300,000.ie S$600 psf.

Tell me how much u can get in SG in Psf??

Say a 4 room flat with 3 bedroom of 85 m2 or 915 sf sold at say $300,000 from open market or $200,000 from HDB.It is S$327 and 219 psf respectively only!!

BTW the land lease of HK run to 2047 only,yes,50 years from 1997.

Even u give discount to normal sales,HK is still much higher!!

利嘉閣 ç ”ç©¶éƒ¨ä¸»ç®¡å‘¨æ»¿å‚‘è¡¨ç¤ºï¼Œä¸Šæœˆå¸‚å ´å‡ºç�¾ä¸€è‚¡å…¬å±‹æ¨“王熱,一連錄得三宗逾百è�¬å…ƒçš„公屋æˆ�交,尤以沙田å�šåº·é¸·å�šæ³°æ¨“高層單ä½�,æˆ�交價更大幅拋離,é�”一百å…å��五è�¬å…ƒï¼ˆè‡ªç”±å¸‚å ´åƒ¹ï¼‰ï¼Œè¼ƒåŽ»å¹´ä¸ƒæœˆæˆ�交的黃大仙 下鸷ä¸å±¤å–®ä½�ï¼Œé€ åƒ¹ä¸€ç™¾äº”å��å››è�¬å…ƒçš„舊紀錄,更上一層樓。

今次æˆ�交的公屋售價,足以與ç§�樓價「看齊ã€�,ç�¾æ™‚沙田å�€è—�籌屋苑,包括沙田第一城å�Šæ²³ç•”花園ç‰ï¼Œå…©æˆ¿å–®ä½�å…¥å ´è²»ç´„æ˜¯ä¸€ç™¾å…å��è�¬å�Šä¸€ç™¾ä¸‰å��è�¬å…ƒã€‚

.....

據了解,å�šåº·é¸·ç‚ºâ—‹äºŒå¹´å‡ºå”®çš„公屋屋苑,在去年剛é�Žäº”å¹´ç¦�售期,期間å�³éŒ„多宗買賣,售價å�‡åˆ—å��大公屋王排å��榜,å�¯è¦‹èº«åƒ¹ä¸�è�²ã€‚據悉,是次æˆ�交的居屋王,實用é�¢ç©�約五百方呎,原æ¥ä¸»åœ¨â—‹äºŒå¹´ä»¥äºŒå��è�¬å…«å�ƒå…ƒå�‘æˆ¿å§”æœƒè³¼å…¥ï¼Œä½†å› æ¥ä¸»å‡ºå”®å–®ä½�ï¼Œé ˆè¦�補地價,故是次售出單ä½�,雖然物æ¥å¸³é�¢å�‡å€¼è¿‘七å€�,但原æ¥ä¸»æ‰£é™¤è£œåœ°åƒ¹æ”¯å‡ºï¼Œå¯¦éš›åˆ©æ½¤å°‡æœƒæ¸›å°‘。

http://hk.news.yahoo.com/080305/60/2q1di.html

2.to be fair,see for more info.

http://web.centanet.com/findproperty/

u can get transactions there to support u!!

3.tx to HK gavaman free economy policy,HK property price is still some 30 to 35 % below 1997 peak.No one dare to cool it down .

Why ?US $$ peg make HK cant use mortgage interest to regulate the economy!!

http://www.centadata.com/cci/cci.htm

-

Originally posted by maurizio13:

Whatever they decide to spend on Defence is their discretion, they can spend $100 billion on defence, but does that mean that all the other countries will follow.The figures from Global Security is from 2005, it's what some countries around the world spend on defence.

It not used to state that it's our budget for the year 2008, it's already stated 2005 in the report.

I used the compilation to show what other bigger countries are spending in defence around the world.

You mean to tell me $6 billion is not enough for a small country to spend on defence?

Maybe you should read the list of countries with less than $6 billion budget on defence.

Sweden, Norway, Denmark, Belgium and Switzerland.

Maybe the Minister of Defence for those countries are not as smart as you.

What are you working as now?

With regards to your accentuation on our inflated defence budget, I have only this remark to add.

After spending $10.5 billion in our defence forces, we can't even catch a soon to be 50 year old limping uncle (Singapore's No.1 Suspect Terrorist Mas Selamat Kastari).

How does that make you feel?

Was the money well spent?

We don't decide our budget following other examples, no country does that.

Why do you think $6 Billion is enough? just don't tell me if other countries can do it with 5 we should do it with 6.

Do you know why Denmark, Sweden, Switzerland can do it with less than 6? I am not as smart as them, that's why they are defence ministers. Obvious isn't it? you think I work as defence minister?

From what you said, we should have the SAF takes over the internal security of Singapore. Do you serve NS? are you a singaporean? never read your post at the military nuts.

-

I can't believe you think the overiding factor in deciding how much to spend in defence is the size of your country.

That's so moronic. Proximity/vulnerbility doesn't matter? Allies? No?

Where do you think the money's going? See the new camps to give soldiers better accomodation? These increase morale and reduce resentment over reservist training. Who benefits? Can I hear an "I do"?

Ever been to a Taiwan military camp? Would you like to serve there? Seriously, it's almost as if you're addicted to comparing with countries that are inferior.

-

Originally posted by deathbait:

I can't believe you think the overiding factor in deciding how much to spend in defence is the size of your country.

That's so moronic. Proximity/vulnerbility doesn't matter? Allies? No?

Where do you think the money's going? See the new camps to give soldiers better accomodation? These increase morale and reduce resentment over reservist training. Who benefits? Can I hear an "I do"?

Ever been to a Taiwan military camp? Would you like to serve there? Seriously, it's almost as if you're addicted to comparing with countries that are inferior.

I think M13 either too young and hasn't gone NS yet, or he escaped with some shameful excuses, or he is not even a Singaporean.